In brief

• The UK Budget appears stable at headline level, but underlying structural changes will significantly increase employment costs and payroll complexity.

• Key reforms to pensions, income tax thresholds and the National Living Wage will reshape reward strategies and workforce planning for the years ahead.

• HR, Reward and Payroll leaders will need to modernise systems, strengthen skills pathways and review operating models to remain compliant and competitive.

When the Chancellor delivered the UK Budget on 26 November, many businesses braced for the impact of sweeping tax hikes or punitive levies. On the surface, this was a budget of continuity rather than shock. But if you dig deeper, these structural reforms could reshape the cost of employment, payroll complexity, and workforce planning for years to come.

A team of our LACE specialists sat down following the announcements to discuss and debate the impact of the Budget on HR and Payroll teams. For Chief People Officers, Heads of Reward, Heads of Payroll, and senior HR leaders, the challenge isn’t deciphering policy intent—it’s translating these measures into practical action.

The UK Budget will compel employers to re-evaluate the composition of their workforce, compensation structures, and capital investment strategies, to manage the increasing business pressures – additional social security costs, the rising cost of minimum-wage labour and the decreasing net value of compensation due to fiscal drag.

Here’s what we think you need to prioritise as we move into 2026.

Reward: The cost of people

While headline tax rates remain unchanged, some of the measures that were announced will significantly increase employment costs. The cumulative effect is significant: employers will need to balance financial pressures with the need to remain competitive in a challenging talent market.

- Salary sacrifice cap on pension contributions (April 2029): A £2,000 annual cap on pension-related salary sacrifice will limit National Insurance (NI) relief above this threshold. For higher earners, this reduces the effectiveness of a commonly-used approach to pensions savings. For a sizeable portion of the workforce, particularly in professional, financial services and tech sectors, this will bite. Higher earners, and those who make large “catch-up” or “maximising” contributions, will feel the loss of NIC relief most. For 20+ years, UK pensions policy has used NIC as a deliberate nudge towards pension saving. This change marks a structural retreat from that nudge, and reframes salary sacrifice as a more limited optimisation tool. The 2029 start date tells you everything — this is technically hard, politically delayed, and fiscally potentially very attractive.

Action: Map exposure – who is impacted and by how much; Financial scenario modelling of potential responses and mitigation; Step back and think about how this change should impact your Pensions and Benefits strategy and how this fits into your reward approach; Consider the operational implementation issues early; Develop your communications plan.

- Income tax threshold freeze (until April 2031): As wages rise, more employees will move into higher tax brackets which reduces take-home pay. Employers may face increased requests for salary reviews as employees become more aware of their reduced take-home pay. Total reward communication will play a vital role in helping employees understand the value of non-cash benefits.

Action: Explore tax-efficient benefits, such as electric vehicle schemes or holiday buy/sell, to help offset the impact of the freezing of the income tax threshold and support employee engagement. Reinforce financial wellbeing education to build awareness and support employee engagement.

- National Living Wage Increase (April 2026): The increase to £12.71 per hour for over-21s is likely to have an impact on pay structures, which may require organisations to review the differences between entry-level and mid-level roles to ensure appropriate differentiation. Sectors with large frontline workforce such as retail, hospitality, care, and logistics will be disproportionately impacted by this increase in cost of employment, and come under additional pressure to reduce their cost base through optimising their operating model.

Action: Evaluate the wider impact on pay structures, job families, and career pathways to ensure fairness and sustainability. Employers seeking to offset the increase in employment costs may need to review their operating model to increase productivity, optimise their staffing model and organisation design, and leverage the efficiency opportunities offered by automation and AI.

Payroll complexity and technology: The digital imperative

The combination of frozen thresholds, new caps, and evolving tax rules adds layers of complexity to payroll operations.

- NIC and tax calculations: Changes to exemptions and structures may increase compliance requirements.

- Homeworking relief removal (April 2026): Employers may need to formalise allowances for remote work.

Action: Consider investing in modern payroll technology that can manage these calculations and support compliance automation. Payroll leaders may wish to prioritise digital transformation to help reduce the risk of errors.

Skills and workforce planning: The ‘use it or lose it’ era

The increased cost of employment necessitates a higher return on investment per employee. Focus on intensive training, upskilling, and performance management to ensure maximum productivity from the workforce.

- Apprenticeship Levy: The reform will introduce new requirements: from April 2026, funds must be used within 12 months, and modular “Apprenticeship Units” will support targeted upskilling in areas such as AI and digital.

Actions:

- Build a responsive apprentice pipeline, as retaining levy funds for extended periods will no longer be possible.

- Define skills taxonomies and prioritise digital capabilities.

- Use modular training to address skill gaps efficiently and flexibly without committing to lengthy programmes.

This shift is not only imperative for learning and development, but also for strategic workforce planning. Organisations that adapt quickly will be better positioned to address capability gaps in key growth areas; organisations that fail to act will face widening capability gaps in critical growth areas.

- Talent attraction and retention: competing with scale-ups

The expansion of Enterprise Management Incentives (EMI) schemes signals a government push to reward employees in high-growth firms. Larger organisations risk losing talent to scale-ups offering tax-advantaged share options.

Action: Review retention strategies and consider alternative incentives that resonate with employees and reinforce loyalty. Benchmark your reward strategy against emerging market practices to stay competitive.

Organisational design and operating models: rewiring for compliance

From wage increases to changes in image rights taxation, the budget continues a trend of placing greater responsibility on employers for defining and funding the cost of work.

Actions:

- Update operating models to hard-wire compliance into core HR processes, technology and ways of working

- Align the organisation design with the organisation’s strategic drivers and growth priorities, with agility to respond to evolving sector-specific needs.

- Provide managers with clear guidance on communicating and managing changes to policies to drive compliance at the frontline.

The bottom line

Although this budget did not introduce dramatic changes, its cumulative effect is significant. For HR and payroll leaders, the coming 12–24 months will be about proactive adaptation: updating systems, rethinking reward strategies, accelerating skills development, and embedding compliance into the operating model.

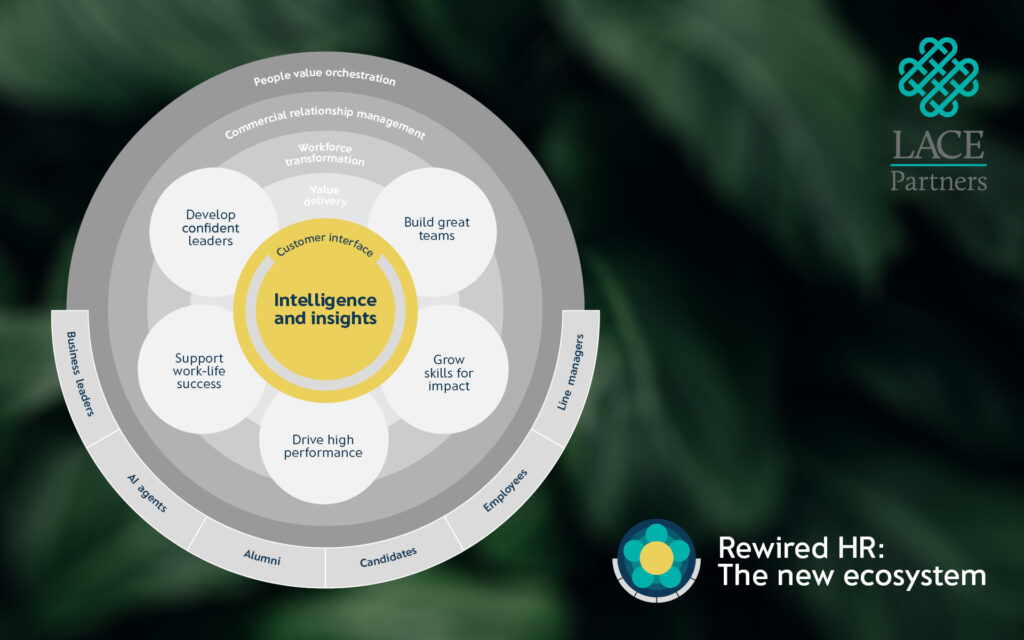

At LACE Partners, we believe the organisations that succeed are those that turn policy into practice efficiently. This shift means sharper workforce planning, thoughtful technology investment, underpinned by an effective operating model and a strong focus on people data and manager capability.

Want to discuss how these changes impact your organisation?

Get in touch with LACE Partners to explore practical solutions for reward, payroll, target operating models, skills, and workforce planning.