In brief:

- How to build a strong business case for payroll investment.

- The real impact of AI on payroll roles and processes.

- Emerging trends in employee expectations and pay transparency.

The Reward Strategy Summit is a UK event that brings together 200+ payroll, reward and HR leaders for strategic discussions on technology, pay, compliance and the future of work. It has run for 21 years and attracts heads of payroll, heads of reward and pay leaders across every sector.

In this episode, Chris Howard, Marketing Director at LACE, sits down with Simon Puryer, Head of Payroll at LACE, and Vickie Graham, Managing Director at Reward Strategy, to discuss insights from the summit such as AI, business-case building, employee expectations and pay transparency. Listen to the episode now:

What were the most important themes from the summit?

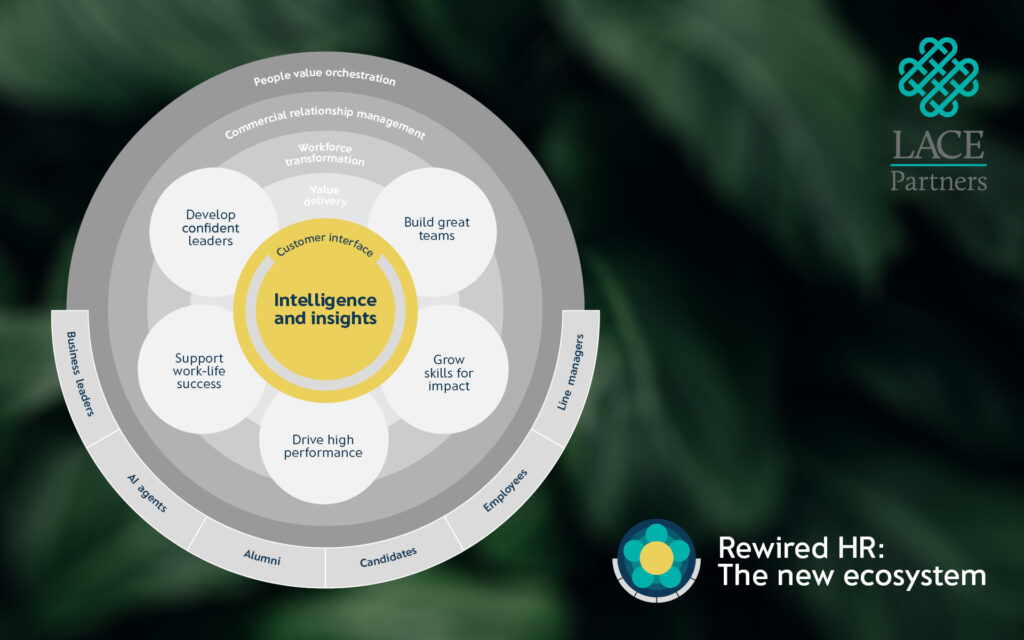

The summit centred on AI adoption, business-case development, and rising employee expectations. These themes appeared across panels, fireside chats and roundtables.

Key themes covered:

- AI and automation: Leaders want clarity on practical use cases rather than hype.

- Business cases for payroll investment: Many teams lack experience presenting to CFOs.

- Employee expectations: Candidates expect employers to show value, not just salary.

- Pay transparency: Interest is rising ahead of the EU Pay Transparency Directive (June 2026).

How is AI changing payroll operations?

AI is improving speed, accuracy and reporting, but not eliminating payroll roles. Panel examples showed reports that once took days are now produced in real time, enabling payroll staff to shift into more analytical, data-driven roles.

Where AI helps

- Rapid reporting and anomaly checks

- Better data validation

- Reducing manual handoffs (some firms discovered 20+ employees informally touching each payroll process)

- Supporting chatbots for routine FAQs—while recognising that pay queries still require human empathy

Why do payroll business cases fail most often?

Payroll business cases often fail because they focus on cost, not value. Leaders at the summit stressed that CFOs need clear language about risk, scale and business impact, not just “we need a new system.”

“Payroll professionals often haven’t had to put together a business case before – and that can feel overwhelming.” Vickie Graham, Reward Strategy

Common pitfalls to avoid:

- Only presenting financials rather than a broader “value case”

- Speaking in payroll language, not business language

- Failing to quantify risk, such as audit failures or compliance penalties

- Underestimating the true number of people involved in payroll

- Saying payroll is accurate and on time, which senior leaders assume is already true

Instead try:

- Show today’s complexity (systems, people, time, hidden manual work)

- Quantify cost avoidance (audit failures, fines, rework hours)

- Tailor messaging to each stakeholder (CFO, CHRO, CIO)

- Present a clear ask: budget, sponsorship, resources

How are employee expectations changing?

Employees now expect a clear value proposition that aligns with their values. They look for transparency in how they are paid, how rewards are structured and how the organisation supports their wellbeing. Employers must articulate total reward, not simply pay.

- What employees want

- Clear salary ranges

- Flexible benefits and hybrid working

- Purpose-driven values

- Consistent, transparent communication

- Faster, more accurate pay interactions

Why is pay transparency becoming a priority?

Pay transparency is rising because of new legislation and cultural expectations. The EU Pay Transparency Directive applies from June 2026, requiring salary disclosure, reporting on pay gaps and easier employee access to pay data. Even UK and US employers are moving toward openness because candidates expect it.

Why organisations are acting now

- To stay competitive in talent markets

- To prepare data systems for disclosure

- To increase trust and retention

- To ensure internal equity and reduce legal risk

What should be Payroll’s priorities in 2026?

Summit leaders plan to focus on AI practicality, pay transparency readiness, employee experience, and value-based reward strategies. The podcast team will also explore practical steps for organisations responding to the EU directive and the next evolution of reward and performance.

📄 Read the Full Transcript

00:00:00 Chris H.

You’re listening to the People Agenda podcast brought to you by leading HR, workforce and payroll transformation specialist, Lace Partners.

00:00:18 Chris H.

Good morning, good afternoon, and good evening, and welcome to the People Agenda Podcast. It’s me, Chris Howard, as always, joining you from Lace Partners and from Lace Partners Central HQ today to talk all things reward and payroll. And to do that, I have none other than our head of the payroll practice, the fabulous travelling Simon Puryer. How are you doing, mate?

00:00:39 Simon P.

I’m good, thank you. How are you?

00:00:40 Chris H.

Good, really good. We’ve got some reflections today, haven’t we? On one of your travels, you’ve recently attended the reward and strategy summit pod and you did a little speaking session there, I believe.

00:00:51 Simon P.

I did. Yeah, I was London-based for once. I wasn’t jet-setting all over the world. Not that I do that very often. It’s just Chris likes to make a point of that.

00:00:58 Chris H.

I’d like to start the pod and say, where are you going on your sorry work in the future. But yeah, so we’re going to have a chat about the Reward Strategy Summit just for 20, 25 minutes. And to do that, we wanted to get the Managing Director of Reward Strategy who run the summit itself. It’s the fabulous Vickie Graham, who is the MD for Reward Strategy.

Vickie, how you doing all right.

00:01:18 Vickie G.

Hi, Chris. Yeah, I’m good. Thank you. Thanks for that introduction. And yeah, Simon didn’t have to go too far for our summit in November, did he?

00:01:26 Simon P.

Maybe next year he’s to make it somewhere like Dubai, Vickie. Make it more interesting. That would be fabulous, wouldn’t it?

00:01:32 Vickie G.

And more interesting just because the location.

00:01:36 Chris H.

Now, we are going to talk about some of the interesting reflections with you guys, because obviously, Vickie, you were there, but the whole day I know you were Simon as well, but you had different parts and you were focused on your particular session that you did with an organisation that we’ve worked with and we’re friends with and I’ll let you do the intros for that in a minute.

Before we do that, Vickie, do you want to, and before I get to my, as usual, fundamentally different question, which if this is the first time you’re listening in, it is a totally random, not related to HR or payroll or reward question, but I just have a little bit of fun at the beginning of the podcast.

But before we do that, Vickie, it might be worth just explaining a little bit of your background to anybody that perhaps haven’t come across you guys or yourself as well.

00:02:14 Vickie G.

Yeah, sure. Thanks for that, Chris. Reward Strategy is a community business and we support and represent individuals who are working within payroll, HR and reward roles, predominantly in the UK, just supporting them through strategic content in their kind of day-to-day roles and how to position themselves in front of their boards within the organizations to get payroll projects signed off and reward strategies implemented successfully with high levels of employee engagement.

As a brand reward strategy has existed for 10 years, prior to which we were a payroll world.

So the summit that I’m very kindly spoke at, very knowledgeably spoke at, was actually the 21st iteration of that event in the UK and London. So we’re very proud of that fact. I myself have been with Reward Strategy since March of this year, so about nine months. Prior to that, I have had 22 years within the payroll and HR profession. Quite a long time, quite experienced, and I’ve got quite a bit of a network built up within that arena.

00:03:19 Chris H.

Yeah, and there’s lots of interesting things that we’re going to dig into. I’m going to get Vickie to talk, maybe give her top two or three most interesting things that she came across and then Simon to talk about his session. But before we do that, It’s a fundamentally different question time. And it’s almost like Vickie’s come prepared for my question because listener, you won’t be able to see this, but she has a wonderful cat who is vying for her attention as we do this podcast and randomly putting his hands on her shoulder and tied to life and links.

00:03:46 Vickie G.

I didn’t really, think you could see that.

00:03:50 Chris H.

But we’re going to get into the fundamentally different question, which was that I’ve just read in the Associated Press that in Argentina, a world record attempt was tried for having the most number of golden retrievers in a park. So A collective of 2,397 Argentinian people, I mean, not all Argentinian, but they’re living in Argentina, have got together in a park to collectively take their golden retrievers out for a walk. So I’m going to start with you. Actually, I’m going to start with Vickie because you’ve got your cat on display from a visual point of view.

And you’ll just have to visualize the audience on this bit. If you could get 2,397 variations of your cat with that same personality into a park, what would be the outcome?

00:04:31 Vickie G.

Yeah, and she has just come vying for my attention. So as you can tell, she likes fuss and attention. So I think there would be thousands of cats vying for attention. But one of the things that, her name is Leah, one of the things that she does, which I’ve never known a cat do before is likes to play fetch. So she comes and brings me a little ball for throwing and then I’ll throw it. She’ll get it, drop it at my feet and keep doing that. So you would have over 2,000 layers coming at you with little tiny cat-sized balls that would just be thrown everywhere. These cats running off in every direction to try and try and get it. And then she, because I have another cat, Luke, so Luke and Leia, she then growls at Luke when he tries to get the ball. So there might be lots of cat fights in that park.

00:05:18 Chris H.

I love it. I absolutely love it. My cat, Iago, is afraid of everything. The park would quickly disperse of all animals as all of them would find the nearest quiet, dark cupboard to go and hide themselves inside them. Simon, what about you? You’ve got a pet I know.

00:05:33 Simon P.

I’ve got a dog. So I have a rescue dog called Benny and he likes to be friends with everyone. So he goes mad when he sees any other dog, any other person, he just wants to go over and get a fuss made of him. And he has this thing of jumps on these back legs and has his little front paws going mad, being like, look at me. So if you had him or versions of him in the park doing that, it would be quite comical, I think, actually to see all these dogs on their back legs doing this kind of jumping up.

00:06:03 Chris H.

I quite like that. I quite like this idea, that visual imagery. The visual imagery of our three sets of animals all in the same park causing absolute chaos. What wasn’t chaos though, notice the awesome segue here, is talking reward and strategy, payrolls.

Let’s kick off with Vickie. Vickie, can you just talk people listening in who perhaps didn’t attend the summit a little bit through perhaps just the types of people that go there? You talked about how long it’s been going on, obviously 21 years, which is amazing. But yeah, talk to me a little bit around, give us a flavour of the day, what it it looks like, the types of people there, how many people you get, and a bit of an overview before we then drill into some of the hot topics from this year.

00:06:42 Vickie G.

Yeah, sure. Thanks, Chris. So the summit itself attracted over 200 attendees across the day, which is great. It’s a one day summit and is made-up of lots of kind of half an hour sessions, which are predominantly panel sessions around strategic thought leadership issues that payroll and reward professionals are facing kind of day-to-day.

And as we look the future from 2026 and beyond. So typically, the people that were in the room were heads of payroll or heads of reward, or heads of pay and reward, as was the case in some of the organizations that were represented there. And they’re across all different sectors and industry types, because pay and reward touches everybody. It’s not something that is just in one area of business. All sectors and industry types are affected. So we did have a wide range of people there.

As I said, the content is very thought leadership, very strategic in terms of the speakers that we had there and the subjects that we were covering. So Simon, you were covering a session on building that business case for investment, which is so important, I think, particularly at the moment with so many changes in technology and looking at making sure you’ve got the right kind of tech stack and processes to support compliant and efficient payroll operations.

So there were lots of sessions around AI and technology, building out that business case, but also around like the employee engagement piece and employee expectations and how that is affecting pay and reward within organizations as well.

00:08:14 Chris H.

Love it. I’m going to start with you actually then, Simon, because Vickie mentioned that business case for investment. Can you give us a little bit of an overview to talk about, obviously we had Nick from Smith and Nephews along. So just talk a little bit about your session. Can we drill down into some of the key interesting points that came from that you wanted to just reflect on?

00:08:33 Simon P.

Yeah, and I guess just before covering that, I just wanted… I guess reiterate Vickie’s point, and Vickie’s probably too polite to say it, but it was an epic day. The kind of the real mix of people that were there at the event, the mix of speakers, the fact that you had a kind of a really nice mix of fireside chats, roundtable conversations. I just felt it was a really, it was a real kind of purpose and meaning for the day, which is really good.

But I think, yes, we were first up actually after Vickie’s opening session, and we cast it as a kind of fireside chat, which works really well because actually Vickie was just chatting to myself, and then, as you mentioned, Nick from Smith and Nephews, who’s one of our existing clients, I’m really trying to bring to life what it means when you’re trying to embark on developing a business case, because I think… What always fascinates me how working with lots of different organizations, how different people will tackle a business case, and ultimately almost what a business case means to different people as well, because I think it’s one of those phrases that gets banded around, but actually, sometimes in its purest sense, someone just knows, wants to know, what money have I got to spend? Whereas other people want detailed breakdown of what’s it going to cost, what are some of the benefits I can achieve, so on and so forth.

So what we really tried to do in that session was bring to life what a business case means, what some of the kind of considerations are to take into account, the kind of steps you need to go through. And obviously having Nick there, he was able to then relate that to his experience of working with us, but also getting that business case through to signing.

00:10:01 Chris H.

So can we give a little bit of a flavour as to the types of things that I’m listening to at the moment? And perhaps I’m working in a payroll team right now and I’m thinking actually, it’s 2025, we’re looking at 2026.

A lot of budgets are obviously set by now, but just for the purposes of this particular pod, what are the types of things that people should be watching out for or what do we recommend organisations do?

00:10:26 Simon P.

Yeah, I think the thing is, there’s this classic, I think, when you think about it, you’ve got to go to a CFO and you’ve got to get funding. I think some people are almost scared by the prospect of that, because CFOs are scary. We know that from our own experience, our own lovely CFO.

I think you feel daunted, especially if you’ve not had to go through this process yourself. So what we try and do is really take a step back and say, actually, what you need to do is bring somebody on the journey with you, you need to bring to life what it is you’re trying to do. Therefore, it’s really important to start with, okay, this is what we’re facing as a payroll operation today. These are the kind of complexities that challenges we’re facing to actually, as I say, make people understand why actually you need some investment. And this investment could be because you’re going to go and put in a new system and therefore you need a significant amount of investment. Or it could be that actually you just need some additional resources or you need some external help to come in and bring about elements of change.

But actually, what you need to do, as I say, is explain today, explain what you’re trying to explain, where you’re trying to get to, but then also ask and clarify what you want. Because again, if you’re talking to a CFO, it’s okay, so what do you want from me? Is it money? Is it sponsorship? What do you need? What we did in the session was really just, as I say, try and step people through that.

00:11:45 Chris H.

Yeah, I’m quite interested. And Vic, I’d love to get your views on this as well, because obviously you listened in to some of this and some of your experience about what you’ve heard from payroll teams that have been going through this pain before. So do you want to jump in and give us any thoughts?

00:11:58 Vickie G.

Yeah, and I was just going to add to that, actually, in terms of what you’ve said there, Simon.

It’s really important to put the business case in terms of what it means to the person that you’re presenting it to and to the organization overall. And I think observations from the session and from what you’ve just said there, quite often payroll professionals haven’t had to put together a business case before. They haven’t had experience in doing that. And therefore there is the overwhelm and the sense of, okay, where do I start? And naturally, people will think about the impact on them and their department and themselves and their team. And they’ll talk very much in that language, which is very important, but they don’t then necessarily relay what the wider implication of that is. So sometimes that message can be misunderstood because we all know that the C-suite CFOs, CEOs, business leaders don’t always understand payroll.

So if you’re talking about the impact at that level, they’re not necessarily understanding what that means for them as a business, which might be why business cases haven’t been signed off before or they’re not getting that level of investment. So I think the what does that mean to me as a CFO and therefore the bottom line and various other aspects and talking the language of the person you’re presenting to is so important.

00:13:21 Chris H.

Yeah, and is it the same when you are presenting to multiple different stakeholders that all have multiple different interests? And what you’re talking about there is almost put yourself in the, to drop a, English literature, GCSE for me, book reference in there, that’s How to kill a Mockingbird, Atticus Finch. You never really know somebody until you walk a mile in their shoes.

But we’re talking about the CFO thing, but actually sometimes you’ll be presenting to different audiences. So do you need to tailor your business case to suit that? Or is it more a case of you’ve got to do more of an overarching C-suite?

00:13:53 Simon P.

Yeah, I think almost the financial element of it is the easy part, really, because actually, to a degree, anyone can create a spreadsheet and show what my cost today, what do I need, what might it look like in the future? I’m oversimplifying it. Ultimately, that’s what you can do. I think it’s what you wrap around that. And to your point of actually, you aren’t just presenting to a CFO, you might need to get CPO buy-in, you might need to get a number of people’s buy-ins before you actually get to the CFO to actually therefore have their sort of sponsorship. But therefore, it’s accepting that what you’re not going to be able to do is just create that spreadsheet and send it in.

You’ve got to actually, as I say, I’m using that phrase again, bring people on the journey, which is why we talk about a lot of it comes down to cost avoidance. Because actually, if you look at a business case in its purest sense, a business case from a just a kind of a, “what does it cost today? What’s it going to cost in the future? What are my savings?” won’t necessarily stack up because if you, especially if you’re going to put in a new system and therefore you might have a very old system that’s not costing you much and actually you suddenly incur that cost to put in a new system, it’s significant. But when you then start to go, but actually we’ve got audit failures in these countries and we’ve had fines in these countries and we’ve got multiple people that we’re having to have touching payroll all over the place. We had a classic case with a different client where we were told that they had three people operating their global payroll. And we were like, yeah, that doesn’t make sense for the volume of people they’ve got operating. They’ve got three people. When we did a deeper dive to get underneath that, we found there was something like 26 people all touching the payroll at different stages that almost they knew nothing about. And when you suddenly then go, okay, 26 plus those three all involved in payroll, you think of the sheer cost that is involved, acknowledging not all the 26 weren’t doing solely payroll, but elements of their role were. And it might be that you’re not going to save headcount, but actually what you can do is re-divert that activity onto something more meaningful from a business perspective.

So again, bringing that to life is really important.

00:15:55 Chris H.

Yeah, and I want to ask a question around the common, is that if there’s a common pitfall that you see businesses that are doing or payroll teams that are doing their business case like a trap that they might regularly fall into in Vic, I want to ask you this quickly, I want to ask you this question as well. But I do think that’s an interesting point of view and what you’ve talked about there with business case. We’re using business case because it’s a common business vernacular. But at least we also talk about value case, value case and business case. That’s synonymous. And I think the reason why we use the word value case is because quite often people doing that, as you said, Simon, is they just associate it with business case equals ask for money. Actually, it’s about demonstrating value. This is the value that we get because it’s not always we spend X, we’re going to get Y in return. There’s other sometimes intangible areas. And that’s why at least we talk about value case, but I’m going to part of that, we’ll continue to call it business case just in this instance.

But if there was one thing that you regularly come across that businesses don’t tend to do, or they don’t think on.

00:16:53 Simon P.

I think you’ve just answered the question.

00:16:55 Chris H.

Oh, really?

00:16:55 Simon P.

Because I think it is that value case. It’s people thinking of it in its purest sense of financials. So actually, I think that’s why a lot of business cases don’t actually work and therefore they don’t get buy in because if we’re something in our personal lives, where we’re looking at a cost today versus a cost in the future, if you just do it in its purest sense, you can’t get it to stack up. So actually, it is, as I say, much more of what sits around it that’s so important. So that for me is the kind of number one mistake that people make.

00:17:25 Chris H.

Yeah, Vickie, like anything that springs to mind, the people that you’ve spoken to or even within businesses that you’ve worked in, if you guys have ever done business cases and a common pitfall, a trap, seems a bit harsh, but pitfall 00:17:38 Chris H.

I’ll stick with pitfall.

00:17:39 Vickie G.

So I think one of the things that’s quite common is payroll professionals particularly will focus on communicating that what they’re looking to introduce is going to mean that the payroll is accurate and on time, which we all know is payroll mantra, right? Pay accurately on time every time. But if they’re presenting to senior leaders who are seeing that is being delivered every pay period anyway, why change it? There isn’t the compelling, to use your words, that the value case, there isn’t that compelling value case as to why to change it because what they’re actually seeing in reality is that it is accurate and it is on time and there are minimal errors. So why invest in whether that’s like the people side of it or the technology side of it when actually things are running smoothly anyway. So I think the pitfall is not communicating what the added value is beyond the accurate and on time.

00:18:34 Chris H.

Love it, Simon.

00:18:35 Simon P.

Yeah, and I think the thing that Vickie just made me think about is one of the slides we showed in the session was a kind of a variation of one that we used in Smith and Nephew, which was showing the kind of complexity of the systems used across the different countries that Smith and Nephew are operating in. And that was a massive milestone when we showed that in Smith and Nephew, because people had no idea that A, almost the countries they were operating in, because reality often people don’t realize just how many, but also more importantly, the kind of complexity they were facing of the number of systems, the number of people involved, actually bringing it to life.

Because as Vickie said, again, I referenced it in the session, you often describe payroll as the kind of wheels on the bus, because people, whilst they’re going round and round, people are like, why bother changing it? But what you’re trying to do with all of this is stop the puncture or stop a wheel falling off, ultimately.

00:19:25 Chris H.

Yeah, I love the metaphor.

00:19:27 Vickie G.

It’s been 3 weeks and I’d only just got that song out of my head.

00:19:30 Simon P.

Sorry, I brought it up again.

00:19:35 Chris H.

Vickie, let’s talk about, so we’ve focused mainly on obviously Simon’s session, which of course was fabulous, Simon, but I just, I want you to draw to it or bring to life a little bit more some of the other aspects of the conference of the summit that you thought were particularly interesting.

And then Simon and I can do a little bit of a riffing off of that. So is there anything that kind of, you want to pull out apart from obviously Simon’s fabulous session, which we have to say again, because keep him smiling.

00:19:59 Vickie G.

There were quite a few common themes across a number of the sessions and the roundtables, because there were a couple of roundtables running at the same time as well that fed into the discussions.

I think #1 was around AI and technology. And I mentioned this at the start. AI is the buzzword in payroll. It’s a buzzword in most professions at the moment. But I think it’s what came out of the summit was there’s still this real uncertainty as to how AI can actually be used and where it’s actually useful. And you made the point, Simon, as well in your session and what you’ve just said now around the number of people, the number of people that they thought were operating the payroll being 3, whereas actually the reality was there was 26 people who were impacting on the payroll in some way and touching it in some way. And I think what came out of the summit around AI was there is this belief that AI will replace certain roles and therefore there will be potentially job reductions within payroll teams or reward teams or any team within an organization. But actually what the reality is of AI is that it will probably shift some of the work or it’ll shift the roles or it’ll change those roles. So you won’t necessarily get that reduction in headcount, but the roles that you do have will change in terms of the value that they’re delivering to the organization.

And we did have some really good examples of that within the AI panel that we had on the payroll side, where some of the reporting that was done within this organization had previously taken days to deliver reports that are now possible in real time at the push of a button. That organisation didn’t make any redundancies. The payroll team was still there and intact, but their roles have changed and they’ve become more analytical. They’ve become more data-driven and more kind of compliance, quality assurance checks. So I think that was something that came out of the summit. It’s just where can that be used and where can that be useful? Chatbots were talked about as well quite a lot because those have been implemented in quite a few organisations. And whilst they do have a place, you still need the people aspect in terms of the empathy and the skills that people bring when they’re dealing with queries around pay, because it’s people’s livelihoods.

So I think there’s that. So that was quite a common theme that came out throughout the whole day, actually. And we’ll be continuing to debate through our content into 2026 as well.

00:22:37 Simon P.

AI is just, it is one of those kind of buzzwords at the moment, really, isn’t it? Everyone’s talking about it. But I think what was interesting in that session was you had a mix of suppliers speaking and their experiences of AI, as well as you say, people that have actually implemented an element of AI. So it was helping bring it to life, I think, which was really interesting.

00:22:58 Chris H.

Do you know what’s interesting as well? I think there’s not enough, and this isn’t so much payroll thing, I think this is more of a business thing, there’s not enough of the explanation of what’s in it for me as an employee. There’s a lot of, there are tools that can be used, but you have to bring it to life for people. You have to bring it to life for people, the average payroll manager and payroll admin assistant, like explaining to them how it can change.

And some of the things you were talking there about, Vickie, are like the ability to crunch numbers and data and analysis and present it back to you in a reporting format that you can then start to work out, okay, what does this mean for my business? What does this mean for the types of skills that my payroll team might need? Everyone, and this isn’t so much a payroll thing, I do the same thing in marketing. Quite often, you’re so busy in the BAU of business life, that you end up, when it comes to thinking about what’s the plans for next year, you end up, what are the plans for the future? How does this evolve? You end up almost, I haven’t got the headspace to do that, that’s a future me problem. But this becomes a now me problem or something that I’ve got time to think about this stuff because I’m able to process information and data.

00:24:09 Simon P.

Yeah, and I think the thing with AI is it is, there is a risk that people just think it’s going to be the answer to everything, that it’s going to change the world. And Vickie, to your point and to yours, Chris, this is about almost enhancing the way things work. But also you’ve got to be realistic about the kind of the steps you’ve got to go through and how quickly you can bring about this change. Because I think, again, some of the panellists were talking about, it’s got to almost be done in bite-sized chunks. You can’t just move to a world of AI and completeness kind of thing.

00:24:38 Vickie G.

Yeah, incremental change. And I think that’s a really good point about enhancing things and it can be used to support your roles. But ultimately, if you’re asking AI to help you with a report to crunch some numbers, you’ve still got to understand what it is doing and the legislation in payroll, the legislation impact and the regulation behind it and things like that, so that you can then use it effectively with the task at hand. There’s no point in asking AI to do something, and then just presenting that back without that sense check and without that knowledge and understanding of what it actually has presented to you.

00:25:18 Simon P.

Yeah, totally agree.

00:25:20 Chris H.

100%. So we’ve probably got about two or three minutes left. So if there are any kind of other bits, I’m going to put two questions into one here, Vicki, if that’s all right. Because I want you to give us a little bit of a flavour as to things you guys have got on your horizon for 2026, things you’re going to be looking at for our listeners. And then also any kind of other bits, maybe snippets from the conference or from the summit that you guys are looking at, okay, this is going to be one of the areas that we’ll focus a bit more on in next year.

00:25:46 Speaker 3

Yeah, so a couple of things that did come out. I think employee expectation changes in terms of what employees are expecting from their organizations that they’re working for, that whole value proposition piece. We’ve talked about it from a business case perspective in terms of the value case, but actually there’s that expectation from employees coming into businesses around what the whole value is, aligning values with their own personal values and their own personal brand to support that recruitment and retention and incentivization of talent within organizations.

And that links really into employee engagement for pay and reward. So I think that was something that was key in that changing kind of expectation of the workforce. And linked with that would be pay transparency. So we know the EU pay transparency directive is coming in and that’s going to be effective from June 2026. But that aside, I think there is more of an expectation around transparency, generally speaking, anyway. So whether you’re in the UK, whether you’re in the US, the EU, wherever you’re situated, the workforce is expecting more transparency about that value proposition, about that transaction of kind of the overall remuneration package around salaries, payroll, flexibility, hybrid working, the benefits package, overall bonus structures, incentives.

There is this real kind of shift in terms of the way people see all of those things and are expecting their organizations to present that information to show that they are, they’re fair, really.

00:27:24 Chris H.

That’s a really good kind of final point. And also it gives me an opportunity to do a little bit of a shameless plug for some of the content that we’re looking at next year, because we have a recently launched or acquired organization that are now the focus of our reward and performance management part of our business. And if you want to go to the latest partners website, if you go to the house services, you can see the reward and performance, check out yourself.

But we’re going to be looking at things like the EU pay transparency. What are the practical things that organizations need to be thinking of. But Vickie, amazing to get some time off you today to talk about the summit. Thank you very much.